Fsa Contribution Limits 2024 Family Loans

Fsa Contribution Limits 2024 Family Loans

Here's how to get a tax break on medical bills through an fsa or hsa, plus new 2025 hsa contribution limits. The 2024 fsa contribution limit for health care and limited purpose accounts is $3,200.

Individuals can contribute up to $4,150 in 2024, up $300 from 2023. The 2024 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2023).

The Internal Revenue Service (Irs) Announced New Cola Adjustments And Maximum Fsa Contribution Limits For 2025.

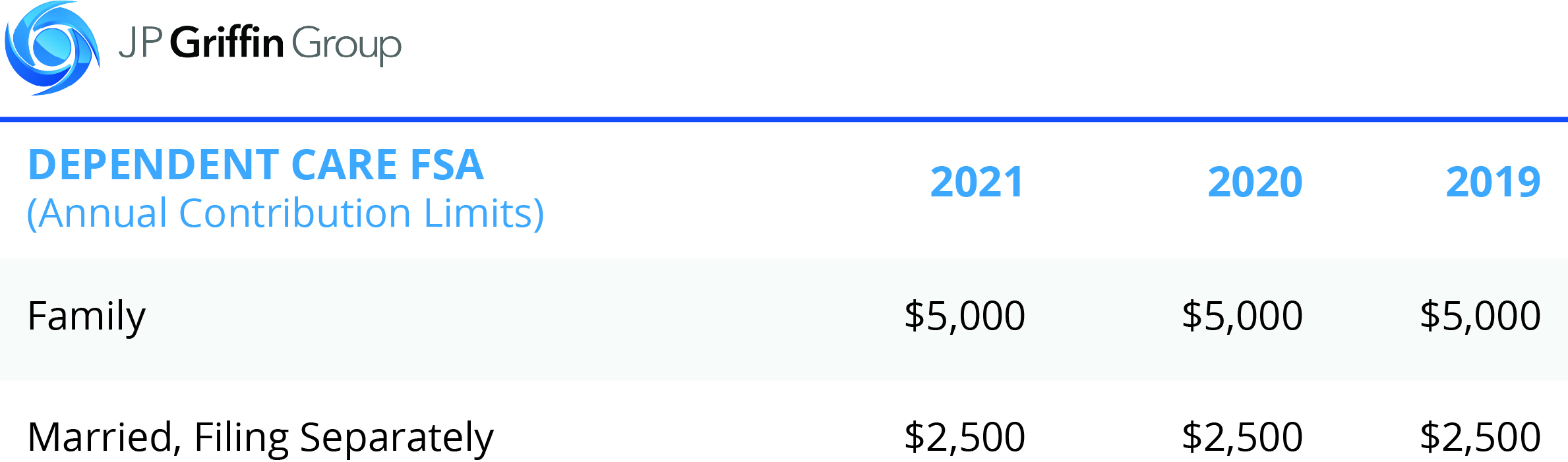

Because of the american rescue plan signed into law in march 2021, the contribution limit has been raised to $5,500 for married couples filing jointly or $2,750 for.

There Are No Changes To Dependent.

The family contribution amount for 2024 rose to $8,300, a $550 increase compared with 2023.

Images References :

Source: clovisqchristy.pages.dev

Source: clovisqchristy.pages.dev

Is There A Fsa Limit Per Family 2024 Anissa HollyAnne, In 2024, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050). Family members benefiting from the fsa have individual limits, allowing a married couple with separate fsas to each contribute up to $3,200, subject to employer.

Source: janelaqgwenora.pages.dev

Source: janelaqgwenora.pages.dev

Fsa Contribution Limits 2024 Averil Devondra, 1, 2024, the contribution limit for health fsas will increase another $150 to $3,200. Each employee may only elect up to $3,200 in salary reductions in 2024, regardless of whether he or she has family members who benefit from the funds in that.

Source: velmaqshelagh.pages.dev

Source: velmaqshelagh.pages.dev

Irs Fsa Max 2024 Joan Ronica, The 2024 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2023). Your employer may set a limit lower than that set by the irs.

Source: www.youtube.com

Source: www.youtube.com

2024 Contribution Limits For The TSP, FSA & HSA YouTube, An fsa contribution limit is the maximum amount you can set. Here’s what you need to know about new contribution limits compared to last year.

Source: romonawmanon.pages.dev

Source: romonawmanon.pages.dev

What Is The Maximum Hsa Contribution 2024 Faye Orelia, The family contribution amount for 2024 rose to $8,300, a $550 increase compared with 2023. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2024 plan year.

Source: www.cleveland.com

Source: www.cleveland.com

IRS increases FSA contribution limits in 2024; See how much, What is the 2024 maximum fsa contribution? Each employee may only elect up to $3,200 in salary reductions in 2024, regardless of whether he or she has family members who benefit from the funds in that.

2024 Fsa Limits Hedi Brunhilda, For 2024, the health fsa contribution limit is $3,200, up from $3,050 in 2023. If the fsa plan allows unused fsa.

Source: www.dspins.com

Source: www.dspins.com

What You Need to Know About the Updated 2024 Health FSA Limit DSP, This is a $150 increase from. The stanford administrative champions has been honored with the team achiever award from the 2024 admin awards.

2024 Limited Purpose Fsa Contribution Limits Tory Katalin, The stanford administrative champions has been honored with the team achiever award from the 2024 admin awards. Employers have the choice to permit carryovers,.

Fsa Contribution For 2024 Austin Florencia, Here’s what you need to know about new contribution limits compared to last year. If the fsa plan allows unused fsa.

The Irs Set A Maximum Fsa Contribution Limit For 2024 At $3,200 Per Qualified Fsa ($150 More Than The Prior Year).

The 2024 fsa contribution limit for health care and limited purpose accounts is $3,200.

Students Must Meet Certain Requirements To Qualify For Financial Aid Through The Federal Government.

This is a $150 increase from the 2023.

Category: 2024