Federal Gift Tax Rates 2024

Federal Gift Tax Rates 2024. The internal revenue service (irs) sets certain thresholds to help regulate gifting. You can give up to $17,000 to most individuals in 2023 and $18,000 in 2024 without being taxed.

Ordinary monetary and property gifts are unlikely to be impacted by this tax, since the yearly limit for 2024 is $18,000 per giver per recipient. This represents the maximum amount an individual can gift to another.

The Federal Income Tax Has Seven Tax Rates In 2024:

While price pressures cooled rapidly in the final months of 2023, progress toward the central bank’s 2% inflation goal has stalled in 2024.

The Internal Revenue Service (Irs) Sets Certain Thresholds To Help Regulate Gifting.

How have the gift and estate tax laws changed in 2024?

Remaining Lifetime Exemption Limit After Gift:

Images References :

Source: www.smartdraw.com

Source: www.smartdraw.com

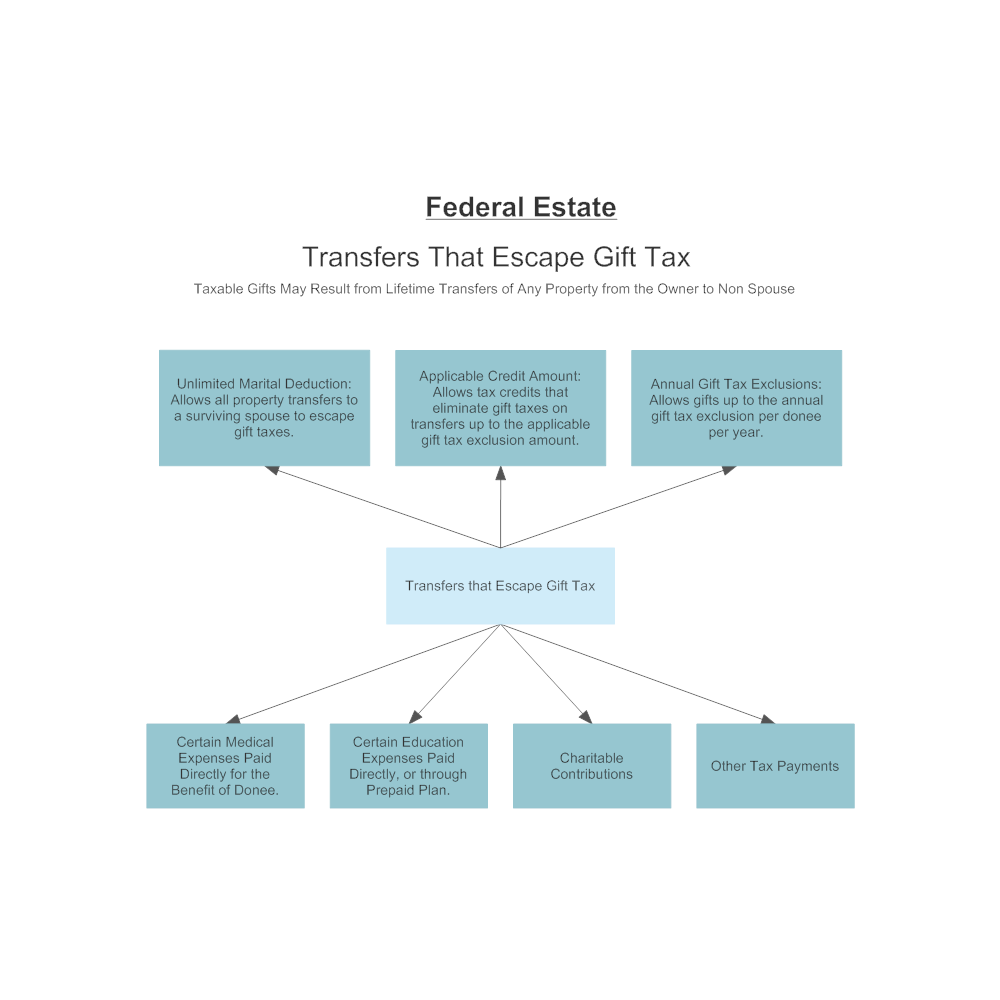

Federal Gift Tax Escapes, For tax year 2024, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples. The gift tax is a federal tax imposed on individuals who give valuable gifts to others.

Source: www.carboncollective.co

Source: www.carboncollective.co

Gift Tax Limit 2022 Explanation, Exemptions, Calculation, How to Avoid It, Value of gifts given in 2024: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Source: www.harrypoint.com

Source: www.harrypoint.com

Historical Estate Tax Exemption Amounts And Tax Rates, The annual gift tax exclusion amount has been adjusted to $18,000 per recipient for 2024. Many provisions in the $1.7 trillion tax cut that republican lawmakers and former president donald j.